The bond market has found a new life, deciding that Bernanke and company are serious about the possibility of ending the tightening cycle sooner rather than later. The Dollar has of course done a complete about face in the past 36 hours, getting hammered again and again. Most commodities are higher if for no other reason than a weaker dollar buys less on the global markets. The precious metals in particular have had huge moves yesterday and today.

How much of these rallies are short covering vs. a new perspective on valuations? I don't know, but I expect to find out after the 4th of July holiday. If commodities can stay up at these levels through the end of next week, we just might have another commodity bull on our hands...

Our TNR model was looking for a reversion day today, but other than some morning chop we didn't get much action. We ended up losing $889 on two trades (one ES, one NQ). The model is calling for a Trending day on Monday in both ES and NQ.

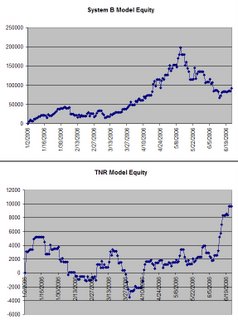

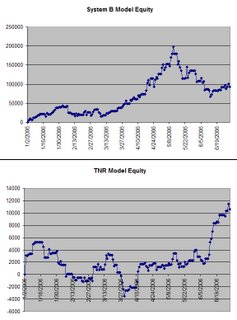

As you can see from the charts on the right, our TNR model has finally found itself in sync with the market this month. We end the month at over $10K in equity with TNR, and better than $90K in the System B model - that represents a 50% return on invested capital, with half the year still to go!

Our open positions:

| Contract | ctrcts | Open P/L | days on | Contract | ctrcts | Open P/L | days on | |

| @US.P | 0 | $0 | 0 | @NG.P | 0 | $0 | 0 | |

| @TY.P | -2 | $456 | 47 | @KC.P | -1 | -$31 | 23 | |

| @FV.P | -4 | $7,675 | 104 | @SB.P | 0 | $0 | 0 | |

| @EC.P | 0 | $0 | 0 | @CT.P | -3 | $8,050 | 56 | |

| @JY.P | 0 | $0 | 0 | @GC.P | 0 | $0 | 0 | |

| @CD.P | 3 | $3,670 | 51 | @SI.P | 0 | $0 | 0 | |

| @C.P | -5 | -$638 | 11 | @HG.P | 2 | $71,775 | 271 | |

| @W.P | 0 | $0 | 0 | @LB.P | -1 | $1,802 | 29 | |

| @S.P | -3 | -$3,763 | 4 | @ES | 0 | $0 | 0 | |

| @CL.P | 0 | $0 | 0 | @YM | 0 | $0 | 0 | |

| @HO.P | 0 | $0 | 0 | @NQ | 0 | $0 | 0 | |

| Total Open Trades | $88,997 | |||||||

| Total Closed Trades | $3,815 | |||||||

| Total | $92,812 | |||||||

Good luck, and have a fantastic 4th of July weekend!