Today was a nice finish to the week, with most of our positions moving in our favor. The two standouts were Copper to the upside (we are long) and Cotton to the downside (we are short). The past two days have been exceptionally difficult for Cotton, undoing weeks of gains, and closing at its lowest point in over a year. Bonds continue to trend down, as does Coffee and Corn. Next week ends the second quarter - let's wait and see how things pan out.

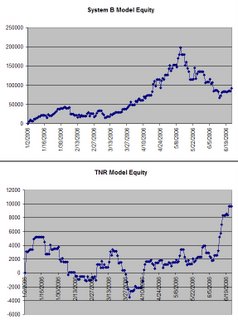

Our TNR model called for a neutral day in both contracts, so no positions were taken. Monday we are looking for a Trending day in both ES and NQ. Our equity curve for our TNR model is finally starting to look like we like to see: sloping up and to the left.

Our open positions:

| Contract | ctrcts | Open P/L | days on | Contract | ctrcts | Open P/L | days on | |

| @US.P | 0 | $0 | 0 | @NG.P | 0 | $0 | 0 | |

| @TY.P | -2 | $1,925 | 42 | @KC.P | -1 | $1,656 | 18 | |

| @FV.P | -4 | $9,425 | 99 | @SB.P | 0 | $0 | 0 | |

| @EC.P | 0 | $0 | 0 | @CT.P | -3 | $8,920 | 51 | |

| @JY.P | 0 | $0 | 0 | @GC.P | 0 | $0 | 0 | |

| @CD.P | 3 | $2,230 | 46 | @SI.P | 0 | $0 | 0 | |

| @C.P | -5 | $988 | 6 | @HG.P | 2 | $61,575 | 266 | |

| @W.P | 0 | $0 | 0 | @LB.P | -1 | $1,439 | 24 | |

| @S.P | 0 | $0 | 0 | @ES | 0 | $0 | 0 | |

| @CL.P | 0 | $0 | 0 | @YM | 0 | $0 | 0 | |

| @HO.P | 0 | $0 | 0 | @NQ | 0 | $0 | 0 | |

| Total Open Trades | $88,158 | |||||||

| Total Closed Trades | $3,815 | |||||||

| Total | $91,973 | |||||||

Good luck, and have a fantastic weekend!

0 Comments:

Post a Comment

<< Home