The precious metals tried for some kind of rally today, but it fizzled in the afternoon, along with Copper prices. The equity markets again fell apart, ending the week on something of a sour note. It certainly has been a notable week for commoditity prices. As I mentioned yesterday, something (possibly dollar related) is taking the air out of virtually all of the commodities that have had such exceptional runs this year to date. The inflection point we talked about a couple of weeks ago seems to have manifested in a reversal for most contracts with big leveraged account interest.

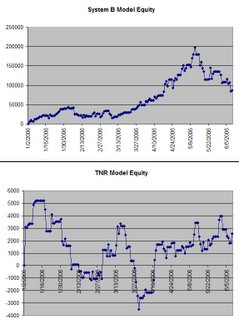

Our TNR model had a decent day today, calling for a reversion day in both contracts. We were stopped out of our NQ trades early, but our ES trade wound up with 4 out of 5 winners. Net total gains on the day were $729. Monday we are calling for a Trending day in ES and a neutral day in NQ.

Our open positions:

| Contract | ctrcts | Open P/L | days on | Contract | ctrcts | Open P/L | days on | |

| @US.P | 0 | $0 | 0 | @NG.P | 0 | $0 | 0 | |

| @TY.P | -2 | -$1,450 | 32 | @KC.P | -1 | $869 | 8 | |

| @FV.P | -4 | $5,050 | 89 | @SB.P | 0 | $0 | 0 | |

| @EC.P | 0 | $0 | 0 | @CT.P | -3 | $1,930 | 41 | |

| @JY.P | 0 | $0 | 0 | @GC.P | 0 | $0 | 0 | |

| @CD.P | 3 | $6,580 | 36 | @SI.P | 0 | $0 | 0 | |

| @C.P | 0 | $0 | 0 | @HG.P | 2 | $63,375 | 256 | |

| @W.P | 0 | $0 | 0 | @LB.P | 0 | $1,549 | 14 | |

| @S.P | 0 | $0 | 0 | @ES | 0 | $0 | 0 | |

| @CL.P | 0 | $0 | 0 | @YM | 0 | $0 | 0 | |

| @HO.P | 1 | $2,845 | 42 | @NQ | 0 | $0 | 0 | |

| Total Open Trades | $80,748 | |||||||

| Total Closed Trades | $5,790 | |||||||

| Total | $86,538 | |||||||

Good luck, and have an enjoyable weekend!

0 Comments:

Post a Comment

<< Home