Moderate strength in the metals outweighed both the bond rally (we are short) and the grain rally (again, we are short Soybeans). The interest rate markets just got a whiff of economic weakness in the Payroll data, and for now, it is looking a bit more likely that the Fed is going to actually follow through on it's threat to pause. On the bright side, Lumber was down and the CAD was up...

Today's rally in Soybeans knocked us right out of our positions - we covered all 3 contracts at the close. That trade will show up in Monday's reports.

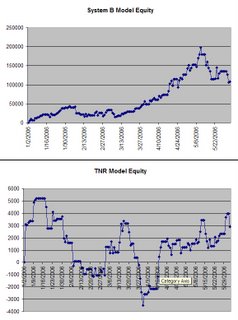

Our TNR model also had a bad day, with both of our reversion trades being stopped out on the morning decline. We lost a net total of -$1064 on the day on two trades. Monday we are calling for a Neutral day in ES and a Reversion day in NQ.

Our open positions:

| Contract | ctrcts | Open P/L | days on | Contract | ctrcts | Open P/L | days on | |

| @US.P | 0 | $0 | 0 | @NG.P | 0 | $0 | 0 | |

| @TY.P | -2 | -$1,513 | 27 | @KC.P | 0 | -$1,138 | 3 | |

| @FV.P | -4 | $4,425 | 84 | @SB.P | 3 | $0 | 0 | |

| @EC.P | 0 | $0 | 0 | @CT.P | 0 | $1,465 | 36 | |

| @JY.P | 0 | $0 | 0 | @GC.P | 3 | $31,680 | 183 | |

| @CD.P | 3 | $7,750 | 31 | @SI.P | 1 | $14,935 | 134 | |

| @C.P | 0 | $0 | 0 | @HG.P | 2 | $79,325 | 251 | |

| @W.P | 0 | $0 | 0 | @LB.P | 0 | $1,362 | 9 | |

| @S.P | -3 | -$4,175 | 8 | @ES | 2 | $0 | 0 | |

| @CL.P | 0 | $0 | 0 | @YM | 0 | $0 | 0 | |

| @HO.P | 1 | $1,526 | 37 | @NQ | 0 | $0 | 0 | |

| Total Open Trades | $135,643 | |||||||

| Total Closed Trades | -$26,915 | |||||||

| Total | $108,728 | |||||||

Good luck, and have a relaxing weekend!

0 Comments:

Post a Comment

<< Home