I will be out of the Office for two week starting Tuesday, 1 August. I will update all trades when I return on the 15th.

This morning's GDP report seemed to cheer US stock and bond markets, raising expectations that the Fed is either done tightening, or very close to being done. It is an interesting sign that reports of a slowdown in growth combined with the highest core inflation rate since 1994 could have the positive reaction that it did.

In other markets, Copper caught a late day bid resulting from nervousness ahead of the Escondida copper mine strike (the vote should be tallied by tonight, but the earliest a strike would happen would be Aug 7th). The grains didn't do much, but there were reports in the market about a widening problem in Florida with Asian Soybean Rust. Gold rallied, Silver was down on the day.

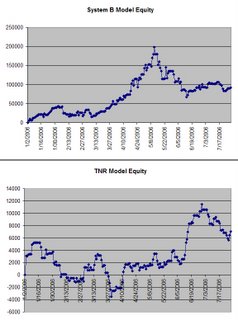

Our TNR model was calling for a Trending day in ES, and that is what we saw. We put on one trade in the morning pop, and rode it all the way to our 4:00 exit. Monday we are looking for a Neutral day in both contracts.

Today's TNR trade:

| Entry | Entry | Exit | Exit | ||||||

| Entry | Time | Price | Exit | Time | Price | Contracts | P/L | ||

| Sell | 10:50 | 1502.75 | ES | Cover | 16:00 | 1487.50 | 2 | $578.00 |

System B positions:

| Contract | ctrcts | Open P/L | days on | Contract | ctrcts | Open P/L | days on | |

| @US.P | 0 | $0 | 0 | @NG.P | 0 | $0 | 0 | |

| @TY.P | 0 | $0 | 0 | @KC.P | -1 | $606 | 42 | |

| @FV.P | 0 | $0 | 0 | @SB.P | 0 | $0 | 0 | |

| @EC.P | 0 | $0 | 0 | @CT.P | -3 | $5,980 | 75 | |

| @JY.P | -1 | -$2,038 | 7 | @GC.P | 0 | $0 | 0 | |

| @CD.P | 0 | $0 | 0 | @SI.P | 0 | $0 | 0 | |

| @C.P | -4 | -$200 | 5 | @HG.P | 2 | $81,475 | 289 | |

| @W.P | 0 | $0 | 0 | @LB.P | -1 | $4,728 | 48 | |

| @S.P | -3 | $1,188 | 7 | @ES | 0 | $0 | 0 | |

| @CL.P | 0 | $0 | 0 | @YM | 0 | $0 | 0 | |

| @HO.P | 0 | $0 | 0 | @NQ | 0 | $0 | 0 | |

| Total Open Trades | $91,739 | |||||||

| Total Closed Trades | -$56 | |||||||

| Total | $91,684 | |||||||

Good luck, and have a relaxing weekend!

0 Comments:

Post a Comment

<< Home