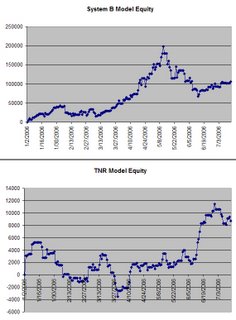

Not a bad end to the week - most of our core positions moved in our favor today, with the exception of bonds and Lumber. Crude had a big day again, but we are not involved (yet). The flight to quality bid continues to flow into US fixed income, the US dollar, and other safe havens. Our system equity is looking good, closing the week over at $105,000, and combined equity (Sytem B and TNR) is almost $115,000 - a 57% return on our capital so far this year!

Monday could prove to be a memorable day in the markets if anything big happens in the Middle East. Lets all hope that things settle down over there soon.

Our TNR model was looking for a reversion day in ES today, but instead we had another decent sized slide. We put on one trade, and were stopped out for a money management loss of -$652. As you can see from the chart, we are up over $8000 in the TNR model YTD.

Our open positions:

| Contract | ctrcts | Open P/L | days on | Contract | ctrcts | Open P/L | days on | |

| @US.P | 0 | $0 | 0 | | @NG.P | 0 | $0 | 0 |

| @TY.P | -2 | -$575 | 56 | @KC.P | -1 | $1,038 | 32 | |

| @FV.P | -4 | $6,238 | 113 | @SB.P | 0 | $0 | 0 | |

| @EC.P | 0 | $0 | 0 | @CT.P | -3 | $11,050 | 65 | |

| @JY.P | 0 | $0 | 0 | @GC.P | 0 | $0 | 0 | |

| @CD.P | 0 | $0 | 0 | @SI.P | 0 | $0 | 0 | |

| @C.P | 0 | $0 | 0 | @HG.P | 2 | $89,650 | 279 | |

| @W.P | 0 | $0 | 0 | @LB.P | -1 | $3,331 | 38 | |

| @S.P | 0 | $0 | 0 | @ES | 0 | $0 | 0 | |

| @CL.P | 0 | $0 | 0 | @YM | 0 | $0 | 0 | |

| @HO.P | 0 | $0 | 0 | @NQ | 0 | $0 | 0 | |

| Total Open Trades | $110,731 | |||||||

| Total Closed Trades | -$4,506 | |||||||

| Total | $106,226 | |||||||

Good luck, and have a great weekend!

0 Comments:

Post a Comment

<< Home