It was a pretty tough week for our models - Copper slid hard, the bonds rallied (not good for our short position) and even Cotton moved against us. On the plus side, our Lumber position continues to gain ground and our Soybean short moved decidedly in our favor today.

The continued strength in Bonds have finally taken its toll. We covered our Five year note position (4 contracts) and our Ten year note position (2 contracts) today at the close.

In addition, the continued grain weakness has us selling short 4 contracts of September Corn today at the close.

All of these new positions will be reflected in Monday's reports.

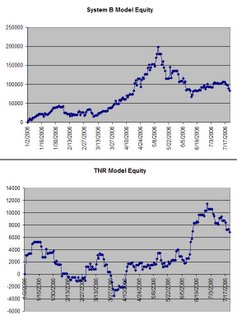

Our TNR model had another tough day, getting short first thing in the morning, and then reversing long, only to be whipsawed down and stopped out at 12:50.

Today's trades:

| Entry | Entry | Exit | Exit | ||||||

| Entry | Time | Price | Exit | Time | Price | Contracts | P/L | ||

| Sell | 09:45 | 1254.25 | ES | Cover | 11:00 | 1252.00 | 2 | $193.00 | |

| Buy | 11:00 | 1252.00 | ES | Sell | 12:50 | 1245.50 | 2 | -$682.00 |

Today's P/L: -$489

TNR YTD P/L : $6833

Our open positions:

| Contract | ctrcts | Open P/L | days on | Contract | ctrcts | Open P/L | days on | |

| @US.P | 0 | $0 | 0 | @NG.P | 0 | $0 | 0 | |

| @TY.P | -2 | -$950 | 61 | @KC.P | -1 | $2,031 | 37 | |

| @FV.P | -4 | $5,800 | 118 | @SB.P | 0 | $0 | 0 | |

| @EC.P | 0 | $0 | 0 | @CT.P | -3 | $6,100 | 70 | |

| @JY.P | -1 | -$738 | 2 | @GC.P | 0 | $0 | 0 | |

| @CD.P | 0 | $0 | 0 | @SI.P | 0 | $0 | 0 | |

| @C.P | 0 | $0 | 0 | @HG.P | 2 | $70,175 | 284 | |

| @W.P | 0 | $0 | 0 | @LB.P | -1 | $4,068 | 43 | |

| @S.P | -3 | $1,113 | 2 | @ES | 0 | $0 | 0 | |

| @CL.P | 0 | $0 | 0 | @YM | 0 | $0 | 0 | |

| @HO.P | 0 | $0 | 0 | @NQ | 0 | $0 | 0 | |

| Total Open Trades | $87,599 | |||||||

| Total Closed Trades | -$4,506 | |||||||

| Total | $83,094 | |||||||

0 Comments:

Post a Comment

<< Home