Everyone was waiting for the USDA crop report today, and the Corn buyers liked what they saw. Total plantings are projected to be the lowest since 2001, and Corn soared on the news to 7 month highs. Since we were short 6 contracts, that wasn't news we wanted to hear! We covered all 6 contracts at the close, for a decent sized loss of $5,725.

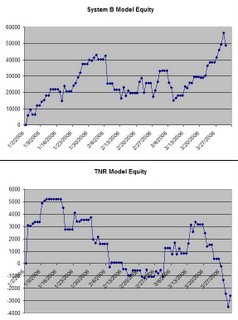

Other than that, March ended on a pretty strong note. We reversed all the drawdown we experienced in February, and then some. We are closing the first quarter with an open and closed equity position of +$48,939 in System B, and -$2,610 in our TNR model, for a Net total of +$46,329. Based on our $200K notional account size, that represents a gain of 23% YTD. Let's hope that continues for the rest of the year!

System B made $879 on 4 trades in ES today, and Monday we are calling for a Trending day.

Our open positions:

| Contract | ctrcts | Open P/L | days on | Contract | ctrcts | Open P/L | days on | |

| @US.P | 0 | $0 | 0 | @NG.P | 0 | $0 | 0 | |

| @TY.P | 0 | $0 | 0 | @KC.P | 0 | $0 | 0 | |

| @FV.P | -4 | $3,800 | 41 | @SB.P | 3 | $10,819 | 129 | |

| @EC.P | 0 | $0 | 0 | @CT.P | 0 | $0 | 0 | |

| @JY.P | -1 | -$575 | 39 | @GC.P | 3 | $17,400 | 140 | |

| @CD.P | 0 | $0 | 0 | @SI.P | 1 | $12,745 | 91 | |

| @C.P | -6 | -$5,525 | 9 | @HG.P | 2 | $21,700 | 208 | |

| @W.P | 0 | $0 | 0 | @LB.P | 0 | $0 | 0 | |

| @S.P | 0 | $0 | 0 | @ES | 2 | $3,825 | 91 | |

| @CL.P | 0 | $0 | 0 | @YM | 3 | -$830 | 12 | |

| @HO.P | 0 | $0 | 0 | @NQ | 0 | $0 | 0 | |

| Total Open Trades | $63,359 | |||||||

| Total Closed Trades | -$14,420 | |||||||

| Total | $48,939 | |||||||

Good luck, and enjoy your weekend!