We had some rather subdued pre-holiday trading today, with Currencies and precious metals moving in our favor, and Bonds, Equities and Sugar moving against us.

At this point, it does seem like the dreaded correction in Gold and Silver prices is ending, and hopefully we'll begin to rally again in earnest. Energy markets snapped back again today, for the second day in a row, but that was not enough to rescue Sugar from the doldrums that have been manifest over the past 2-3 weeks.

Our TNR model finally produced a winning day, getting short NQ and riding it to our 4:00 exit. Fortunately for us the mid-day logjam broke down, not up, and we netted $402 on that one trade (shorting 3 contracts). TNR is calling for a Trending day in ES and NQ on Tuesday.

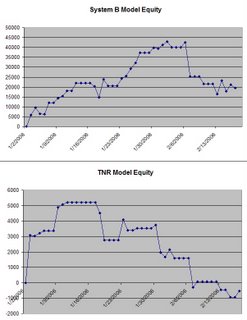

As you can see from our equity charts that I've posted today, the first half of February has not been overly kind to us. We've given back quite a bit. Hopefully, we will start to see a renewed push in some of our better markets through the end of the month.

Our positions:

| Contract | ctrcts | Open P/L | days on | Contract | ctrcts | Open P/L | days on | |

| @US.P | 0 | $0 | 0 | @NG.P | 0 | $0 | 0 | |

| @TY.P | 0 | $0 | 0 | @KC.P | 0 | $0 | 0 | |

| @FV.P | -4 | $550 | 12 | @SB.P | 3 | $8,904 | 100 | |

| @EC.P | 0 | $0 | 0 | @CT.P | 0 | $0 | 0 | |

| @JY.P | -1 | -$625 | 10 | @GC.P | 3 | $9,270 | 111 | |

| @CD.P | 2 | -$180 | 20 | @SI.P | 1 | $2,650 | 62 | |

| @C.P | 0 | $0 | 0 | @HG.P | 2 | $7,950 | 179 | |

| @W.P | 0 | $0 | 0 | @LB.P | 0 | $0 | 0 | |

| @S.P | 0 | $0 | 0 | @ES | 2 | $3,425 | 61 | |

| @CL.P | 0 | $0 | 0 | @YM | 0 | $0 | 0 | |

| @HO.P | 0 | $0 | 0 | @NQ | 0 | $0 | 0 | |

| Total Open Trades | $31,944 | |||||||

| Total Closed Trades | -$12,400 | |||||||

| Total | $19,544 | |||||||

Good luck, and enjoy your (long) weekend!

0 Comments:

Post a Comment

<< Home