With today's surge in the metals, we finished another week on a strong note. It seems that the continued dollar weakness is turning around the precious metals markets.

Despite Bernanke's congressional testimony, I don't see how the Fed will be able to stop raising interest rates for any prolonged period. Commodity inflation seems to be quite entrenched right now, with even the grains starting to show signs of stirring from the doldrums they have been in.

We exited our Soybean position on the close today, covering 2 contracts at the close. That position will be reflected in Monday's reports.

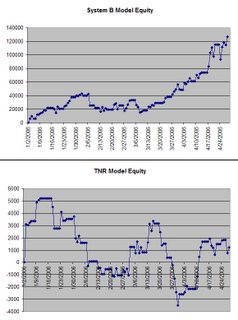

Our TNR model was calling for a reversion day in both contracts, and that is what we saw in NQ. Our ES position was stopped out on the morning rally. Net gains on the day were $1010 for NQ and a loss of -$532 in ES, for a Net total gain of $478.

Our open positions:

| Contract | ctrcts | Open P/L | days on | Contract | ctrcts | Open P/L | days on | |

| @US.P | 0 | $0 | 0 | @NG.P | 0 | $0 | 0 | |

| @TY.P | -2 | -$638 | 3 | @KC.P | 0 | $0 | 0 | |

| @FV.P | -4 | $4,925 | 60 | @SB.P | 3 | $9,240 | 148 | |

| @EC.P | 0 | $0 | 0 | @CT.P | 0 | $3,265 | 12 | |

| @JY.P | 0 | $0 | 0 | @GC.P | 3 | $37,740 | 159 | |

| @CD.P | 3 | $3,640 | 7 | @SI.P | 1 | $22,060 | 110 | |

| @C.P | 0 | $0 | 0 | @HG.P | 2 | $66,775 | 227 | |

| @W.P | 0 | $0 | 0 | @LB.P | 0 | $0 | 0 | |

| @S.P | -2 | -$2,275 | 18 | @ES | 2 | $5,100 | 110 | |

| @CL.P | 1 | -$470 | 9 | @YM | 3 | $1,345 | 31 | |

| @HO.P | 1 | $2,261 | 13 | @NQ | 3 | -$2,375 | 16 | |

| Total Open Trades | $150,594 | |||||||

| Total Closed Trades | -$23,758 | |||||||

| Total | $126,836 | |||||||

Good luck, and have a fantastic weekend!

0 Comments:

Post a Comment

<< Home